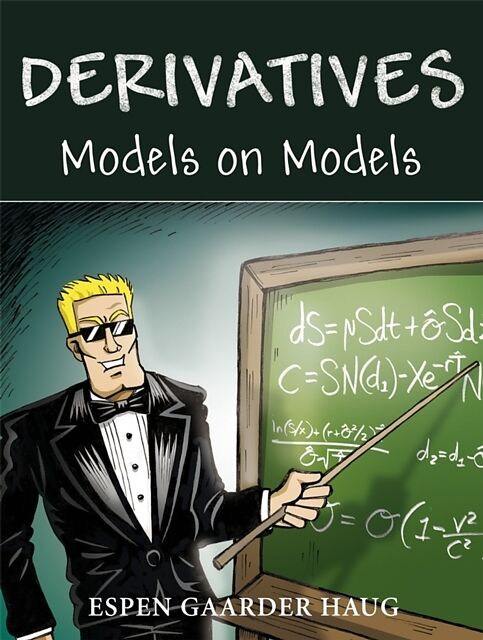

Derivatives

Einband:

Fester Einband

EAN:

9780470013229

Untertitel:

Models on Models

Genre:

Betriebswirtschaft

Autor:

Espen Gaarder Haug

Herausgeber:

Wiley

Auflage:

1. Auflage

Anzahl Seiten:

384

Erscheinungsdatum:

01.06.2007

ISBN:

978-0-470-01322-9

A high level, theoretical and practical look at the latest and most important derivatives pricing models which will include illustrative comic strips and interviews with top traders. Haug aims to bring (an often dry) subject to life through entertaining cartoons and interviews with practitioners.

Informationen zum Autor Dr Espen Gaarder Haug has more than 15 years of experience in Derivatives research and trading, and has worked for more than 20 years as a trader. Until recently he worked as a proprietary trader in J.P. Morgan New York, and as a derivatives trader for two multi-billion dollar hedge funds; Amaranth Investor and Paloma Partners, located in Greenwich Connecticut. Before that he worked for Tempus Financial Engineering, Chase Manhattan Bank (now J.P. Morgan Chase) and Den Norske Bank. He is the author of The Complete Guide of Option Pricing Formulas , which has become a reference manual among Wall Street professionals. He has a PhD from the Norwegian University of Science and Technology where he specialized in Option Valuation and Trading and has published extensively in practitioner and academic journals. He is currently considering setting up his own investment company - possibly the first Anti-Hedge fund! Klappentext This book takes a theoretical and practical look at some of the latest and most important ideas behind derivatives pricing models. In each chapter the author highlights the latest thinking and trends in the area. A wide range of topics is covered, including valuation methods on stocks paying discrete dividend, Asian options, American barrier options, Complex barrier options, reset options, and electricity derivatives. The book also discusses the latest ideas surrounding finance like the robustness of dynamic delta hedging, option hedging, negative probabilities and space-time finance.The accompanying CD with additional Excel sheets includes the mathematical models covered in the book.The book also includes interviews with some of the world's top names in the industry, and an insight into the history behind some of the greatest discoveries in quantitative finance. Interviewees include:Nassim Taleb on Black SwansEdward Thorp on Gambling and TradingAlan Lewis on Stochastic Volatility and JumpsEmanuel Derman, the Wall Street QuantPeter Carr, the Wall Street Wizard of Option Symmetry and VolatilityClive Granger, Nobel Prize winner in Economics 2003, on CointegrationStephen Ross on Arbitrage Pricing TheoryBruno Dupire on Local and Stochastic Volatility ModelsEduardo Schwartz the Yoga Master of Quantitative FinanceAaron Brown on Gambling, Poker and TradingKnut Aase on Catastrophes and Financial EconomicsElie Ayache on ModelingPaul Wilmott on Paul WilmottAndrei Khrennikov on Negative ProbabilitiesDavid Bates on Crash and JumpsPeter Jäckel on Monte Carlo Simulation Zusammenfassung This book takes a theoretical and practical look at some of the latest and most important ideas behind derivatives pricing models. In each chapter the author highlights the latest thinking and trends in the area. A wide range of topics is covered, including valuation methods on stocks paying discrete dividend, Asian options, American barrier options, Complex barrier options, reset options, and electricity derivatives. The book also discusses the latest ideas surrounding finance like the robustness of dynamic delta hedging, option hedging, negative probabilities and space-time finance.The accompanying CD with additional Excel sheets includes the mathematical models covered in the book.The book also includes interviews with some of the world's top names in the industry, and an insight into the history behind some of the greatest discoveries in quantitative finance. Interviewees include:Nassim Taleb on Black SwansEdward Thorp on Gambling and TradingAlan Lewis on Stochastic Volatility and JumpsEmanuel Derman, the Wall Street QuantPeter Carr, the Wall Street Wizard of Option Symmetry and VolatilityClive Granger, Nobel Prize winner in Economics 2003, on CointegrationStephen Ross on Arbitrage Pricing TheoryBruno Dupire on Local and Stochastic Volatility ModelsEduardo Schwartz the Yoga Master of Quantitative FinanceA...

Autorentext

Dr Espen Gaarder Haug has more than 15 years of experience in Derivatives research and trading, and has worked for more than 20 years as a trader. Until recently he worked as a proprietary trader in J.P. Morgan New York, and as a derivatives trader for two multi-billion dollar hedge funds; Amaranth Investor and Paloma Partners, located in Greenwich Connecticut. Before that he worked for Tempus Financial Engineering, Chase Manhattan Bank (now J.P. Morgan Chase) and Den Norske Bank. He is the author of The Complete Guide of Option Pricing Formulas, which has become a reference manual among Wall Street professionals. He has a PhD from the Norwegian University of Science and Technology where he specialized in Option Valuation and Trading and has published extensively in practitioner and academic journals. He is currently considering setting up his own investment company - possibly the first Anti-Hedge fund!

Klappentext

This book takes a theoretical and practical look at some of the latest and most important ideas behind derivatives pricing models. In each chapter the author highlights the latest thinking and trends in the area. A wide range of topics is covered, including valuation methods on stocks paying discrete dividend, Asian options, American barrier options, Complex barrier options, reset options, and electricity derivatives. The book also discusses the latest ideas surrounding finance like the robustness of dynamic delta hedging, option hedging, negative probabilities and space-time finance. The accompanying CD with additional Excel sheets includes the mathematical models covered in the book. The book also includes interviews with some of the world's top names in the industry, and an insight into the history behind some of the greatest discoveries in quantitative finance. Interviewees include: Nassim Taleb on Black Swans Edward Thorp on Gambling and Trading Alan Lewis on Stochastic Volatility and Jumps Emanuel Derman, the Wall Street Quant Peter Carr, the Wall Street Wizard of Option Symmetry and Volatility Clive Granger, Nobel Prize winner in Economics 2003, on Cointegration Stephen Ross on Arbitrage Pricing Theory Bruno Dupire on Local and Stochastic Volatility Models Eduardo Schwartz the Yoga Master of Quantitative Finance Aaron Brown on Gambling, Poker and Trading Knut Aase on Catastrophes and Financial Economics Elie Ayache on Modeling Paul Wilmott on Paul Wilmott Andrei Khrennikov on Negative Probabilities David Bates on Crash and Jumps Peter Jäckel on Monte Carlo Simulation

Inhalt

Author's "Disclaimer" ix Introduction x Derivatives Models on Models xv Nassim Taleb on Black Swans 1 Chapter 1 The Discovery of Fat-Tails in Price Data 17 Edward Thorp on Gambling and Trading 27 Chapter 2 Option Pricing and Hedging from Theory to Practice: Know Your Weapon III 33 1 The Partly Ignored and Forgotten History 34 2 Discrete Dynamic Delta Hedging under Geometric Brownian Motion 44 3 Dynamic Delta Hedging Under Jump-Diffusion 50 4 Equilibrium Models 54 5 Portfolio Construction and Options Against Options 55 6 Conclusions 63 Alan Lewis on Stochastic Volatility and Jumps 71 Chapter 3 Back to Basics: A New Approach to the Discrete Dividend Problem 79

Together with Jørgen Haug and Alan Lewis 1 Introduction 79 2 General Solution 82 3 Dividend Models 87 4 Applications 89 Emanuel Derman the Wall Street Quant 101 Chapter 4 Closed Form Valuation of American Barrier Options 115 1 Analytical Valuation of American Barrier Options 115

Leider konnten wir für diesen Artikel keine Preise ermitteln ...

billigbuch.ch sucht jetzt für Sie die besten Angebote ...

Die aktuellen Verkaufspreise von 6 Onlineshops werden in Realtime abgefragt.

Sie können das gewünschte Produkt anschliessend direkt beim Anbieter Ihrer Wahl bestellen.

Loading...

Die aktuellen Verkaufspreise von 6 Onlineshops werden in Realtime abgefragt.

Sie können das gewünschte Produkt anschliessend direkt beim Anbieter Ihrer Wahl bestellen.

| # | Onlineshop | Preis CHF | Versand CHF | Total CHF | ||

|---|---|---|---|---|---|---|

| 1 | Seller | 0.00 | 0.00 | 0.00 |