Numerical Methods for Finance

Einband:

Fester Einband

EAN:

9781584889250

Untertitel:

Englisch

Genre:

Allgemeines & Lexika

Autor:

John Edelman, David Appleby, John Miller

Herausgeber:

Taylor and Francis

Anzahl Seiten:

312

Erscheinungsdatum:

21.09.2007

ISBN:

978-1-58488-925-0

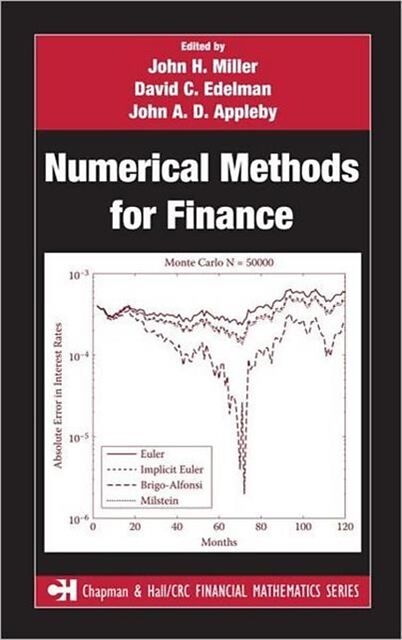

Informationen zum Autor John A. D. Appleby ! David C. Edelman! John J. H. Miller Klappentext Featuring international contributors from both industry and academia! Numerical Methods for Finance explores new and relevant numerical methods for the solution of practical problems in finance. It provides valuable! practical information about credit risks! exotic/hybrid options! retirement plans/pensions! life insurance! portfolio selection! incentive schemes! and interest rate modeling. The book presents a variety of novel mathematical methods involving finite-difference! Monte Carlo! and fast Fourier transform techniques. It also offers realistic alternatives to the VaR approach used in financial risk management practice and identifies potential pitfalls of standard methodologies. Zusammenfassung Explores relevant numerical methods for the solution of practical problems in finance. This book discusses the coherent risk measures theory and how it applies to practical risk management. It proposes a method for pricing high-dimensional American options. Inhaltsverzeichnis Coherent Measures of Risk into Everyday Market Practice. Pricing High-Dimensional American Options Using Local Consistency Conditions. Adverse Inter-Risk Diversification Effects for FX Forwards. Counterparty Risk under Correlation between Default and Interest Rates. Optimal Dynamic Asset Allocation for Defined Contribution Pension Plans. On High-Performance Software Development for the Numerical Simulation of Life Insurance Policies. An Efficient Numerical Method for Pricing Interest Rate Swaptions. Empirical Testing of Local Cross Entropy as a Method for Recovering Asset's Risk-Neutral PDF from Option Prices. Using Intraday Data to Forecast Daily Volatility: A Hybrid Approach. Pricing Credit from the Top Down with Affine Point Processes. Valuation of Performance-Dependent Options in a Black-Scholes Framework. Variance Reduction through Multilevel Monte Carlo Path Calculations. Value at Risk and Self-Similarity. Parameter Uncertainty in Kalman Filter Estimation of the CIR Term Structure Model. EDDIE for Discovering Arbitrage Opportunities. Index. ...

Autorentext

John A. D. Appleby , David C. Edelman, John J. H. Miller

Klappentext

Featuring international contributors from both industry and academia, Numerical Methods for Finance explores new and relevant numerical methods for the solution of practical problems in finance. It provides valuable, practical information about credit risks, exotic/hybrid options, retirement plans/pensions, life insurance, portfolio selection, incentive schemes, and interest rate modeling. The book presents a variety of novel mathematical methods involving finite-difference, Monte Carlo, and fast Fourier transform techniques. It also offers realistic alternatives to the VaR approach used in financial risk management practice and identifies potential pitfalls of standard methodologies.

Zusammenfassung

Explores relevant numerical methods for the solution of practical problems in finance. This book discusses the coherent risk measures theory and how it applies to practical risk management. It proposes a method for pricing high-dimensional American options.

Inhalt

COHERENT MEASURES OF RISK INTO EVERYDAY MARKET PRACTICEMotivationsCoherency Axioms and the Shortcomings of VaR The Objectivist Paradigm Estimability The Diversification Principle RevisitedSpectral Measures of Risk Estimators of Spectral Measures Optimization of CRMs: Exploiting ConvexityConclusions PRICING HIGH-DIMENSIONAL AMERICAN OPTIONS USING LOCAL CONSISTENCY CONDITIONSIntroduction FormulationOutline of the Method Stability AnalysisBoundary Points ExperimentsConclusionsADVERSE INTER-RISK DIVERSIFICATION EFFECTS FOR FX FORWARDSIntroduction Related ResearchThe ModelPortfolio and DataResultsConclusionsCOUNTERPARTY RISK UNDER CORRELATION BETWEEN DEFAULT AND INTEREST RATESIntroduction General Valuation of Counterparty RiskModeling AssumptionsNumerical MethodsResults and DiscussionResults Interpretation and ConclusionsOPTIMAL DYNAMIC ASSET ALLOCATION FOR DEFINED CONTRIBUTION PENSION PLANSSummary of Cairns, Blake, and DowdON HIGH-PERFORMANCE SOFTWARE DEVELOPMENT FOR THE NUMERICAL SIMULATION OF LIFE INSURANCE POLICIESIntroductionComputational Kernels in Participating Life Insurance PoliciesNumerical Methods for the Computational KernelsA Benchmark Mathematical Model Numerical Experiments Conclusions References AN EFFICIENT NUMERICAL METHOD FOR PRICING INTEREST RATE SWAPTIONSIntroduction Pricing Swaptions Using Integral TransformsPricing Swaptions Using the FFTApplication and Computational AnalysisModel Testing Using EURIBOR Swaptions DataConclusions and Future ResearchEMPIRICAL TESTING OF LOCAL CROSS ENTROPY AS A METHOD FOR RECOVERING ASSET'S RISK-NEUTRAL PDF FROM OPTION PRICESIntroductionMethodologyResultsConclusionUSING INTRADAY DATA TO FORECAST DAILY VOLATILITY: A HYBRID APPROACHIntroduction The Hybrid Framework Adding Intraday Data to the FrameworkConclusion PRICING CREDIT FROM THE TOP DOWN WITH AFFINE POINT PROCESSES Extended AbstractVALUATION OF PERFORMANCE-DEPENDENT OPTIONS IN A BLACK-SCHOLES FRAMEWORKIntroduction Performance-Dependent OptionsNumerical ResultsVARIANCE REDUCTION THROUGH MULTILEVEL MONTE CARLO PATH CALCULATIONSIntroductionMultilevel Monte Carlo Method Numerical ResultsConcluding Remarks VALUE AT RISK AND SELF-SIMILARITYIntroduction The Set Up Risk Estimation for Different Hurst Coefficients Estimating Hurst ExponentsUsed Techniques Estimating the Scaling LawDetermining the Hurst Exponent InterpretationConclusion and OutlookAcknowledgmentPARAMETER UNCERTAINTY IN KALMAN FILTER ESTIMATION OF THE CIR TERM STRUCTURE MODELIntroductionDynamic Term Structure ModelsDifferential Evolution ResultsConclusionEDDIE FOR DISCOVERING ARBITRAGE OPPORTUNITIESINDEX

Leider konnten wir für diesen Artikel keine Preise ermitteln ...

billigbuch.ch sucht jetzt für Sie die besten Angebote ...

Die aktuellen Verkaufspreise von 6 Onlineshops werden in Realtime abgefragt.

Sie können das gewünschte Produkt anschliessend direkt beim Anbieter Ihrer Wahl bestellen.

Loading...

Die aktuellen Verkaufspreise von 6 Onlineshops werden in Realtime abgefragt.

Sie können das gewünschte Produkt anschliessend direkt beim Anbieter Ihrer Wahl bestellen.

| # | Onlineshop | Preis CHF | Versand CHF | Total CHF | ||

|---|---|---|---|---|---|---|

| 1 | Seller | 0.00 | 0.00 | 0.00 |